Automating and maintaining a consistent flow of qualified leads is essential for growth. The best way to keep this flow is by using marketing funnels.

With a marketing funnel, professionals can reach their target customers and help convert them into clients through their buying journey. To provide an enhanced client experience, you need to learn how to create and implement a marketing funnel based on the buyer’s journey.

What Is A Marketing Funnel?

““A marketing funnel describes your customer’s journey with you.“”

I like to think of marketing funnels as blueprints that build upon three main questions:

- Why do they need this service?

- Why should they choose you?

- How do they get started?

The funnel is the customer’s buying journey. It consists of three main stages:

- TOFU – Top of Funnel

- MOFU – Middle of Funnel

- BOFU – Bottom of Funnel

In each stage, the prospect is getting closer to making a buying decision. By setting up a funnel in each step of the process, you help lead the customer to you as a trustworthy option.

Financial and insurance professionals can use marketing funnels to offer new services to existing clients while marketing to prospects. A well-crafted funnel helps generate leads and enhance the overall client journey.

Why Do You Need A Marketing Funnel?

One of the primary reasons behind using a marketing funnel is that it helps you re-engage your audience at every stage of their buying journey. This allows financial professionals to stay top-of-mind as a prospect makes their buying decision. Without a marketing funnel, the campaign can be disjointed and a lot less effective.

A marketing funnel will further help professionals create an excellent level of awareness for their target market, upsell their services and maximize customer value. Professionals can also interact with their audience and provide value, resulting in increased trust.

What is the most essential aspect of a marketing funnel?

Your goal. Many marketing campaigns fail because there is no quantifiable goal. So if your marketing campaign is to host a webinar, what’s the webinar’s goal, and how do you determine its success?

Having a goal and KPIs is crucial in determining a campaign’s success and improving future campaigns.

What Is An Example Of A Marketing Funnel?

As mentioned earlier, marketing funnels are the buying journeys of clients. Some of the models include:

- Instagram Ad → Website Landing Page → Lead Conversion

- Blog Article → CTA → Lead Conversion

- White Paper → Website Landing Page → Lead Conversion

The marketing funnel examples we have mentioned above are pretty straightforward, and they should be.

Realize that your funnel may get more complicated as you add more components to a campaign.

How Does A Marketing Funnel Work?

A marketing funnel works in several stages, from the awareness stage to the evaluation stage, to the buying phase. To understand the concept of a marketing funnel, we will look at an example while explaining each stage.

TOFU – Top of Funnel – Awareness

TOFU is the top of the funnel, and at this point, your prospect recognizes a problem but is in the beginning learning stage. In this stage, they are researching their problem and gathering general data.

Your goal is to position yourself as the expert. You want to guide your prospect to make an informed decision, helping position you or your firm as a trustworthy solution.

Example of TOFU

Problem:

The client is learning about the need for life insurance.

Campaign Goal:

Obtain prospect contact information.

Funnel:

E-Book: “Life Insurance Planning Guide”

CTA:

Download eBook

MOFU – Middle of Funnel – Interest

The next stage is the “middle of the funnel.” Once they have a better idea of their problem, they will search for more information on how to solve it. These prospects are closer to making a buying decision but not quite ready.

In this stage in the funnel, your goal is to provide information to directly help them make a buying decision. Below is an example of what the MOFU stage looks like.

Example of MOFU Campaign

Problem:

The client is now considering purchasing term life insurance.

Campaign Goal:

Obtain prospect contact information.

Funnel:

PDF Download: “10 Things to Know About Term Life Insurance Before Buying”

CTA:

Download PDF

You may think this is similar to the last funnel, but here is the difference: The client is looking for general planning concepts in the TOFU funnel, while in the MOFU funnel, the prospect is looking for “term insurance” and information “before buying.” Meaning they are further down the buying journey as they have specified their search.

BOFU – Bottom of Funnel

Last but not least, we have the bottom of the funnel. This is the most critical part of the decision-making process. The bottom of the funnel is where the prospect chooses who to move forward with.

Depending on what you are offering, your prospect will either move forward with a service provider or request a proposal.

Example of BOFU Campaign

Problem:

The client is now considering who to purchase term life insurance from.

Goal:

Obtain quoting details on the prospect.

Funnel:

Get Started

CTA:

Request Quotes

Step-By-Step Guide To Create A Marketing Funnel

Now that you understand the three stages of a marketing funnel, we will review the different aspects to consider when building your funnel.

Create a goal

Once you have determined your goal, you’ll be able to build out the funnel. This will help you align your campaign and funnel so that when the campaign is over, you can review your results and tweak them for better performance.

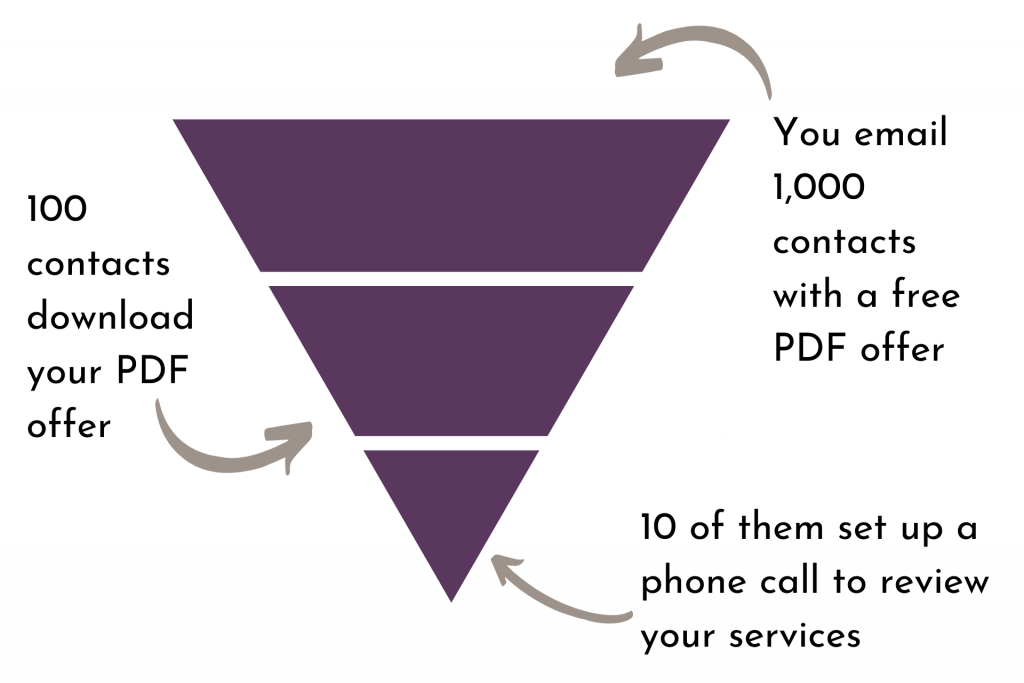

Most goals are revenue-driven, and to reach your revenue goal, you need to develop a lead generation goal. Most of us learned the 10-3-1 rule, which looks like this:

Every 10 qualified leads should lead to 3 booked appointments, leading to one sale.

So what does that look like in the digital world?

Every 10 form submissions should lead to 3 RFPs, leading to one sale.

Understand your Audience

Your audience is a critical factor in your messaging. Without a good understanding of your audience, it will be difficult to appeal to their problems, wants, and needs.

This means you may have to develop different campaigns to reach different audiences. A business owner will have a different set of needs compared to a C-Suite executive. Using the correct messaging will be important to reach them.

Determine your Funnel Stages

Next, you’ll need to map out your prospect’s buying journey. Then you’ll be able to group their activities into the different funnel stages. The stages include TOFU, MOFU, and BOFU.

Think like your prospect

After researching your audience and funnel stages, you need to determine marketing strategies for each funnel stage of your buyer’s journey.

One of the best ways to think through the stages is to pretend like you’re the client looking for information related to the problem you solve.

Here is an example of how you may approach that research if you were buying a new car:

Buying Journey of Buying a New Car

First, you may start with Googling “Most fuel-efficient SUVs.” Here you are just getting a general idea. Then your second Google search will be “Best fuel-efficient mid-sized SUVs.” At this point, you have identified the type of car but not the model. In the third stage, you are ready to buy, so you’ll be looking for a dealership and/or pricing, so you may Google “Subaru dealerships near me” or “lowest-priced Subaru Outbacks.”

Determine Marketing Tactics for Each Stage

TOFU Stage Marketing Tactics

You may write articles, create ads, or share video guides on social media or websites in the TOFU stage. The goal is to build trust and awareness. Most of the content here is considered “Evergreen Content,” meaning it shouldn’t expire like “What is a 401(k)?” or “What should my umbrella policy cover?”

MOFU Stage Marketing Tactics

Common strategies during the MOFU stage include product reviews, case studies, ebooks, whitepapers, product comparisons, and email drip campaigns. At this stage, you want to dial into more specific needs and problems. The goal is to establish trust while they are evaluating different options.

BOFU Stage Marketing Tactics

During the last stage (BOFU), your goal is to secure a meeting or a request for a proposal/quote. The client will most likely want to conduct an appointment before purchasing coverage or moving assets. This will occur via email or on a landing page on your website.

Marketing Funnel Ideas

Here are some marketing funnel ideas that many financial and insurance professionals use.

Webinar Funnels

Webinars are a great way to inform a larger group of prospects about your expertise. The “”personal”” aspect of webinars will help you build trust with future clients. Furthermore, webinars are less expensive but will require a good presentation and presenter.

One thing many firms miss with their webinars is a call-to-action. So what do you want your prospect to do after the webinar? This question should be considered to help you determine your overall webinar campaign goal.

Seminar Funnels

In the financial services industry, seminars are still a viable marketing tool, and many companies still use them. What we see now is instead of cold prospects, seminars are used with existing clients. As more firms move away from the free meal seminar for prospects, many have transitioned into client events to discuss specific planning ideas.

Content Funnels

Content funnels help your business find new leads. This is a multi-stage idea. Various types of content are used to generate new leads and convert them into clients. For example, content could be anything from a white paper to an eBook to a PDF download. The goal is to provide something of value in exchange for their contact information.

Appointment Funnels (Schedule a Meeting)

These are usually reserved for your BOFU stage. Once your prospect has downloaded different types of content or spent enough time on your website, you may start an email drip campaign to request a meeting.

Some companies try to set this up as a TOFU stage but find low engagement since the prospect hasn’t engaged with the brand, making it challenging to convert through email alone.

Conclusion

Many financial and insurance advisors use marketing funnels to generate new leads, but many don’t apply the concept.

By starting to think about your marketing in a more formulaic process, you’ll be able to generate new clients at a lower acquisition cost resulting in better use of your ad spend.

If you plan to create marketing funnels for your customers, you can download our marketing funnel template and project their buying journey.